2019 Results in brief

1. Sector Contributions and Benefits Paid

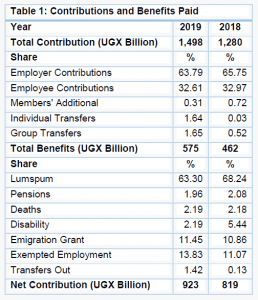

In 2019, total contributions increased by 17.2% to UGX 1.50 trillion from UGX 1.28 trillion in 2018. The increase was attributed to improved compliance in remittance by employers to schemes owing to ongoing supervisory activities, conversion of gratuity arrangements into retirement benefit schemes, new employer and employee registrations and annual employee salary increments.

The total amount paid as benefits to members and beneficiaries in 2019 was UGX 575 billion, an increase of 24.5% over UGX 462 billion paid in 2018. Accordingly, the net contribution increased by 12.7% to UGX 923

billion compared to UGX 819 billion in the previous year. Refer to Table 1 for details on Contributions and Benefits Paid.

2. Sector Investment Portfolio

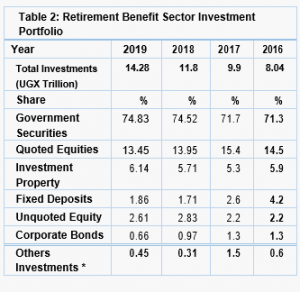

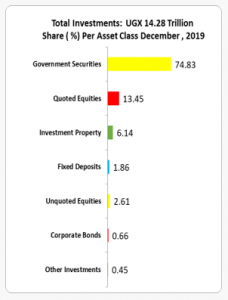

The Sector Investment Portfolio grew by 20.9% from UGX 11.8 trillion in 2018 to UGX 14.28 trillion in 2019. (Refer to Table 2 for details on Retirement Benefits Sector Investment Portfolio). In 2019, net income and net member contributions were the main contributors for the growth in the investment portfolio.

There were no major changes in the Sector portfolio structure. Government securities accounted for the major portion of assets 74.83%. Equities made up 16.06%, Investment property 6.14%, fixed deposits 1.86%, corporate bonds 0.66%, and other investments1’ which accounted for 0.45%.

3. Income of the Sector

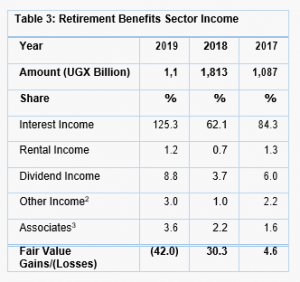

During the period under review, the Sector earned UGX 1.5 trillion on account of interest, rental income, dividends, associates, and other income. However, there was a UGX 452 billion loss resulting from marking to market of the equity portfolio and foreign exchange loss. In effect, the Sector recorded total income of UGX 1.1 trillion, although short-term fluctuations do not affect long-term Sector performance. Refer to Table 3 for details on Retirement Benefits Sector Income.

4. Sector Operational Expenditure

The total Sector operational expenditure increased to UGX 165 billion in 2019, registering a 22.2% increase compared to UGX 135 billion in 2018. The cost drivers included Retirement Benefits Schemes staff expenses 50.6% (UGX 84 billion), service provider costs (including trustees, custodians, fund managers, administrators, auditors and actuaries) 13% (UGX 21 billion), other expenses (including consultancy costs, annual general meetings, utilities and maintenance, advertising and promotions etc…) 32% (UGX 53 billion), and statutory costs (levies and licenses paid by schemes and service providers) 4.5% (UGX 7 billion).

The cost-asset ratio increased to 1.3% compared to 1.2% in 2018, attributable to the rate of increase in sector operation costs (22.2% increase to 165 Billion from 135 Billion in 2018) exceeding the rate of increase in sector assets (13.8% increase from to 13.2 trillion from UGX 11.6 trillion in 2018). The cost-income ratio was maintained at 13% as in the previous period.

Operational costs must be considered among the most potentially decisive factors affecting sector performance. The Authority estimates indicate that an increase of 1% in annual charges on assets results in a reduction of future benefits of over 43% after 40 years of contributions. Reducing operational expenditure requires understanding of expenses and structure is a priority for long term sector development.

To address the issue of costs, the Authority issued Financial Reporting and Disclosure Regulations which improved disclosure of fees and charges, and enhanced the comparability of charges of different service providers. Other supervisory responses introduced by the Authority include:

- Umbrella schemes where various employers and their employees make contributions under one scheme. This intervention is expected to, in the long-term extract economies of scale, thereby reducing costs of administration and investment, and broadening access to additional asset

- Trustee Training Programme to be offered at the Insurance Training College (ITC) to enhance Trustee knowledge and skills in scheme management and operation which are major ingredients for good governance.

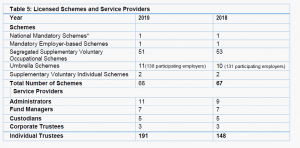

5. Licensed Entities

By end 2019, the Sector had 66 licensed schemes with a total of 2,393,462 million member accounts, registering an increase of 5% compared to 2,272,970 million member accounts recorded by end 2018. (Refer to Table 5 for details on Retirement Benefit Schemes and Service Providers licensed by the Authority). In the period under review, the proportion of Uganda’s workforce under some form of retirement benefit arrangement was estimated at only about 16%. So, the immediate challenge facing the Retirement Benefits Sector in Uganda is coverage that will enable all workers to have a decent retirement.

Increasing coverage among formal sector workers, and extending coverage to the informal sector requires regulatory reforms, design and formal adoption of systems and processes to support coverage. The Authority is leading in efforts to increase coverage among formal and informal sector workers.

6. Supervision of the Sector

In line with the provision of Section 5(b) and (c) of the URBRA Act 2011, the Authority conducted on-site inspections/due-diligence as well as off-site examinations. These supervisory activities were carried out to ensure a sound and sustainable Retirement Benefits Sector.

The Authority conducted offsite surveillance on 64 retirement benefits schemes, due-diligence on 7 fund managers and onsite inspections on 10 retirement benefits schemes. The major supervisory concerns included;

- Unremitted and unallocated contributions to members accounts

- Unpaid benefits and forfeiture of member benefits

- Failure to allocate interest to members with unpaid benefits

- Payment of members’ benefits to employers’ bank accounts

- Non-compliance with Service Level Agreements

- Inadequate disclosure of transactions made through related

The Authority issued supervisory directives to address the concerns, and recovered UGX. 1.2 billion that comprised of misappropriated funds and unremitted contributions. The funds were credited to the respective retirement benefits schemes’ custodial accounts.

Download Full Report using the link below;