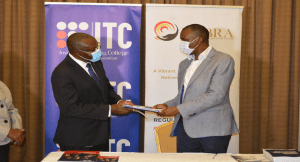

Kampala, Uganda, April 16th, 2021 – Today, The Insurance Training College (ITC) and Uganda Retirement Benefits Regulatory Authority (URBRA) officially unveil the commencement of the Trustee Training and Certification Programme that is intended to improve and enhance the professionalism of trustees.

The launch signifies the roll-out of the training programme that will be conducted by the ITC on behalf of URBRA as part of the minimum requirements for any trustees to be licensed by URBRA. Trustees form the foundation upon which the pensions sector is built. They manage the schemes in trust on behalf of their members.

The programme is in line with ITC’s mandate of enhancing professionalism in the financial services sector as well as URBRA’s mandate of improving and promoting the development of the retirement benefits sector.

Although the training is primarily aimed at Trustees of Retirement Benefits Schemes, it has been structured in such a way that it benefits other players within the pensions sector. The programme beneficiaries will thus spread to include Scheme Members, Fund Managers, Fund Custodians, and Pension Managers. Other target beneficiaries include CEOs and managers in the financial services sector and Institutions.

The programme also targets human capital management practitioners, to equip them with information on benefits’ provisions and management as they develop benefits packages for the staff of their institutions.

Saul Sseremba, the ITC Chief Executive Officer and Principal said, “the training is vital to ensure pension funds are efficiently managed especially in an environment of changing economic and social circumstances.”

Sseremba reiterated the College’s commitment to training that equips trustees with advanced knowledge and management tools needed for the effective oversight and administration of all the retirement benefits schemes.

Martin Nsubuga, Chief Executive Officer URBRA outlined the key benefits of the training programme saying, “Ugandans can look forward to a wide range of benefits including better-managed retirement benefits schemes; informed investment decisions by Trustees; growth of the sector due to increased trust in scheme management; and growth of savings owing to better investment decisions.”

He further said that improvements in the Trustee capacity and professionalism will enhance scheme performance, reduce fraud and boost public confidence in the sector. The programme will also enhance the regulator’s ability to communicate and engage sector players, increase efficiency and reduce turnaround times for decision making. The programme will act as a catalyst for involvement and engagement for all sector players and the enforcement of sector standards.

About ITC

Established in 1964, the Insurance Training College (ITC) is the training arm of Uganda’s Insurance sector with a mandate to carry out Education, Training and Professional Development in the Insurance and financial services sector. The above mandate is recognized under the Insurance Act 2017. The college has linkages and partnerships locally, regionally and globally that help it tap into the workforce and professional development.

About URBRA

URBRA is an autonomous body established by virtue of Section 2 of the Uganda Retirement Benefits Regulatory Authority Act 2011. It is responsible for regulating the establishment, management and operation of retirement benefits schemes in Uganda in both the private and public sectors. URBRA is an oversight body and NOT a Retirement Benefits Scheme.

FOR DETAILS, CONTACT,

1. Agnes E Nantaba

ITC Public Relations Officer – +256758158383/ anantaba@itc.ac.ug

2. Lydia Mirembe

URBRA, Manager Corporate and Public Affairs – +256752749857 lydia.mirembe@urbra.go.ug