PRESS RELEASE

RETIREMENT BENEFITS SECTOR RECORDS GROWTH IN ASSETS AND INTEREST PAID TO SAVERS

Kampala, 3rd December, 2024 – Uganda’s retirement benefits sector is now worth UGX 25.40 Trillion, an 18.6%increment from UGX21.4 trillion in 2023. Equally, the sector’s contribution to the national GDP has grown to 12.2%, up from 10% in 2023 .

Kampala, 3rd December, 2024 – Uganda’s retirement benefits sector is now worth UGX 25.40 Trillion, an 18.6%increment from UGX21.4 trillion in 2023. Equally, the sector’s contribution to the national GDP has grown to 12.2%, up from 10% in 2023 .

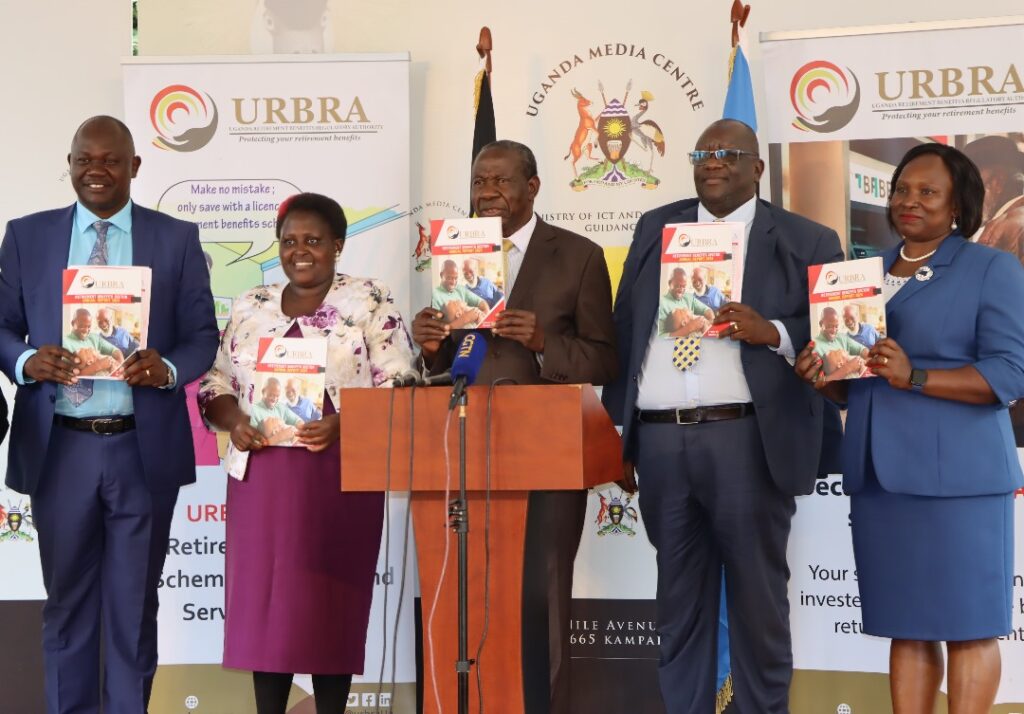

This was announced by Hon Matia Kasaija, Minister for Finance Planning and Economic Development as he released the Annual Sector Performance Report 2023/2024 published by The Uganda Retirement Benefits Regulatory Authority (URBRA).

The robust supervision and the sector’s strategic allocation of resources contributed to significant growth. Net income of UGX 3.10 trillion and net member contributions of UGX 989.94 billion were pivotal. Fixed income securities, accounting for over 90% of total income, remained the backbone of investment performance, offering attractive risk-adjusted returns.

Elaborating the key factors in recoveries, “Our risk-based supervision system played a crucial role in recovering UGX 23.3 billion for members, emphasizing transparency and risk management,” said Mrs. Rita F. Nansasi Wasswa, URBRA’s Acting CEO.

Membership in retirement benefits schemes grew by 7%, totalling 3.37 million accounts. Contributions increased by 8.3% to UGX 2.39 trillion, driven by enhanced employer compliance, new registrations, and salary increments. Average member balances rose to UGX 10.22 million, reflecting improved member confidence.

Despite significant achievements, URBRA remains committed to addressing low coverage in Uganda’s informal sector, which comprises 85% of the workforce. The Authority is spearheading the National Long-term Savings Scheme (NLTSS) to enable informal workers to save for retirement, leveraging digital platforms for accessibility.

“We aim to bridge the gap by tailoring solutions for the informal sector, ensuring every Ugandan has a pathway to financial security post-retirement,” noted Hon. Julius Junjura Bigirwa, URBRA Chairman Board of Directors.

The reassurance of members about their savings was reflected in the investments, returns and reforms as highlighted below;

- Investment Income: Gross investment income rose by 38.3% to UGX 3.62 trillion, driven by fixed-income instruments and robust equity performance.

- Interest Rates: Members enjoyed an average interest rate of 10.99%, up from 10.49% in FY 2022/23.

- Sector Reforms: URBRA introduced regulatory measures to improve operational efficiency, reduce costs, and enhance member outcomes.

Amidist the growth, the sector has always identified challenges such as low coverage and inadequate private pension design. URBRA is advocating for structural reforms to ensure sustainable, adequate, and secure retirement benefits for all Ugandans, with a focus on sustainability, inclusivity, and member outcomes, the report underscores.

“Our vision is a vibrant, secure, and inclusive retirement benefits sector. The progress in FY 2023/24 sets a strong foundation for achieving this,” Mrs. Wasswa concluded.

## END##